We're doctors.

We get it.

It can be reliably said that the

“traditional insurers” treat malpractice

insurance as a commodity, rather than

as the professional service it should be.

A real commitment to strict underwriting and claims management should help maintain a solid, stable rate and coverage for our insureds.

A real commitment to strict

underwriting and claims management

should help maintain a solid, stable

rate and coverage for our insureds.

WHY JOIN?

WHY JOIN?

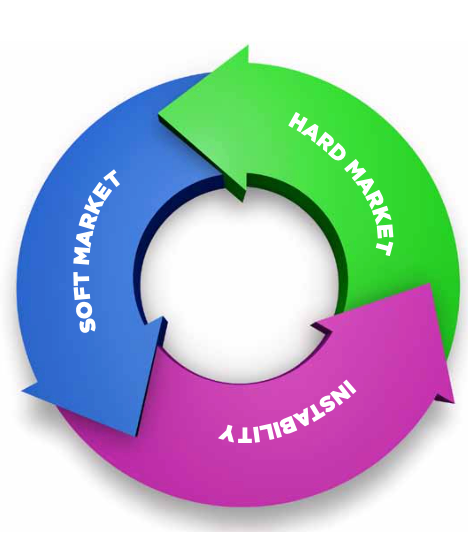

Cyclical Instability

DocSecure’s consistent focus on individual physician underwriting, risk management, and claims handling provides a way to counter the effects of these cycles.

Own vs. Rent. It’s that simple.

Nationwide, over 50% of physicians receive their medical malpractice insurance through self insurance. The malpractice market is poised to change after recent years of pressure from increasing losses and a shrinking pool of clients as the best physicians migrate to self-insuring within a company like DocSecure.

So we are inviting the best physicians to get to know us, and consider stepping off the malpractice merry-go-round cycle so they too can control their own destiny through owning vs. renting this important protection.

A physician may be concerned about stability when deciding to change companies...

We understand that is a legitimate concern, and one we wanted to solve from the very start of the company.

So we began with several core values:

1) Being well capitalized

2) Adding to our team the nation’s top risk advisory firm

3) An experienced management team in place

4) Partnering with the nation’s 6th largest malpractice insurer

This combination literally gives us the security and all of the solvency protections available from two multi-billion dollar companies.

Today, DocSecure is as secure and safe as any of our competitors, if not more so.

The look of a privately held company with the security of the largest companies in the industry!

Our fronting partner arrangement allows us to share in their best in the business product features, plus add a few one of a kind products of our own. Any physician who joins can be assured that they will not have to compromise on any of the coverage they had previously. We match or provide better terms in almost every case.

In Search of the Entrepreneurial Spirit...

.

If you were one of these kids,

chances are good you are the

perfect candidate for DocSecure.

If you were one of these kids,

chances are good you are the

perfect candidate for DocSecure.

.

If you were one of these kids,

chances are good you are the

perfect candidate for DocSecure.