NOW THERE’S AN INSURANCE OPTION THAT WORKS FOR THE BEST PERFORMING PHYSICIANS.

Why was DocSecure formed and what makes us different from other insurance companies?

In the mid 2000’s during the last spike in malpractice rates known as the “hard” market, a group of the very best physicians we knew got together. We were all disappointed with the way the traditional malpractice companies were increasing our premiums, forcing us to settle claims, and generally doing very little to support physicians during the trauma that accompanies the malpractice litigation process. We felt there had to be a better way. So we assembled the best team we could find to build an insurance company that had the interest of the physicians at the core of everything it did. That extends to competitive pricing, profit sharing, having the best defense attorneys, the most innovative products, and a unique service approach that actively coaches and supports physicians who may be sued.

A Paradigm Shift for Medical Malpractice

DocSecure is changing the “traditional” insurance business model, in which all doctors are largely deemed the same, regardless of their medical malpractice loss history. Instead, DocSecure underwrites each physician using strict and exclusive underwriting/selection criteria that combines for each physician such critical data as: educational background, early residency and practice experience, practice specialty board certification status, recognized professional expertise and medical malpractice loss history.

In addition, our members participate in developing and implementing our risk management practices.

With fewer insurers, limits on coverage and large rate increases on the horizon, malpractice challenges are destined to escalate. DocSecure is owned by its insured physicians, which allows medical malpractice insurance availability, coverage limits, and pricing to be influenced by those who can manage it best... Physicians!

What we do?

DocSecure is a special purpose captive insurance company owned entirely by its insured physicians, each of whom owns stock in DocSecure. (full details regarding the financial structure of DocSecure will be made available in the prospectus).

In the DocSecure insurance program, each insured physician purchases insurance directly from a credible, highly-rated insurance company authorized to write insurance in the state

in which the insured physician is located, currently Coverys. DocSecure insures its physicians through a reinsurance agreement between the Coverys and DocSecure. This business model allows DocSecure to provide some of the insurance for its physicians, while having the ability to limit DocSecure’s losses through the terms of the reinsurance contract with Coverys.

This arrangement is designed to strengthen DocSecure’s financial position and long-term stability and viability. Participation in DocSecure is selective; DocSecure is designed for physicians and medical practices who want to have more control over their malpractice insurance options

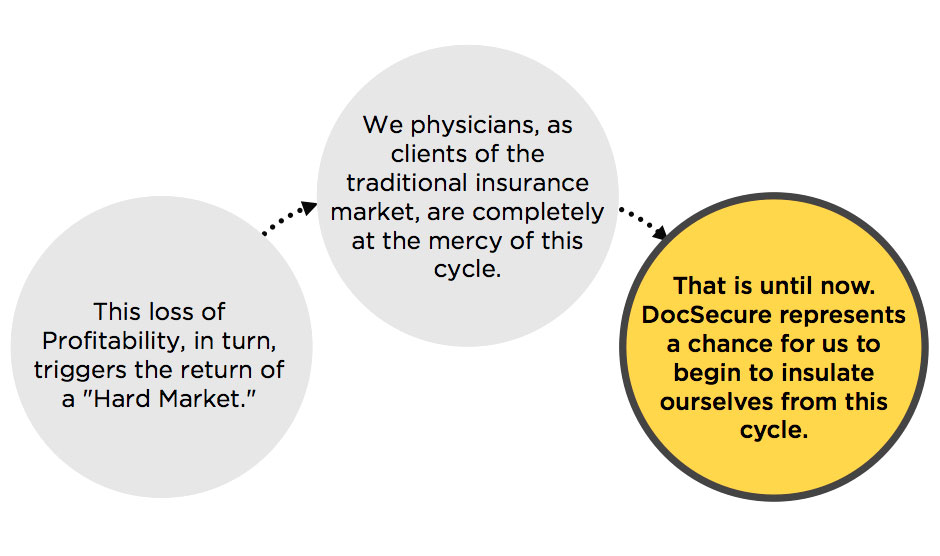

– and who do not want to be completely reliant on insurance companies who focus more on profits than service. If you’re tired of the uncertain and unstable malpractice insurance cycle and prefer to be evaluated on your own capabilities, consider becoming a part of DocSecure.

The fronting carrier, a member of the Coverys Group, is the nation’s 7th largest malpractice insurer and a leading insurer of physicians in NJ & nationwide.

We also engaged Arthur J. Gallagher Co., the largest broker of physician medical malpractice insurance in the Unites States.

This sound and detailed structure protects our Insured Members, as Coverys ultimately assumes all of the insurance liability, in the extremely unlikely circumstance that DocSecure was unable to meet its obligations.

Why Coverys is the perfect structural partner?

Physician Insurer culture with over 20,000 clients

30+ yrs of successful operation

Over $2,000,000,000 in Assets

Rated “A” (Excellent) by AM Best

Admitted market in New Jersey

Additional DocSecure Structual Details

DocSecure retains 25% of the first million dollars of coverage to a maximum of $250,000 on any single loss... large losses cannot overly financially damage the company.

When the Company deems it appropriate, the DocSecure Captive entity has the structural foundation and option to convert to a full Risk Retention Group.

The DocSecure Captive has been financially and operationally structured to meet the future requirements of a Risk Retention Group (RRG), ensuring no difficulty with conversion.

(NOTE: Show both Coverys and Gallagher logos in this section. Also show jpg structural breakdown Coverys chart along with AM Best A rating pdf in this section.)

Why We Continue to Succeed?

Our underwriting and selection criteria are more demanding regarding the educational and professional backgrounds of our candidates.

Specific selection of only the best performing physicians in select specialties done peer to peer.

We believe we have advantages over the traditional market in Corporate Structure, Service, Risk Management, and in our Product Line.

THE DocSecure DIFFERENCE...

100% ownership, management and control by DocSecure’s insured physicians.v

Peer-to-peer underwriting for preferred risk selection.

Purchase of direct insurance from a licensed and authorized direct insurer, currently Coverys, with an “A” rating from AM Best Co.

Physician-centric claims and risk management focus.

Unique and varied coverage options that can be tailored to meet the needs of our insured physicians.